Understanding Reverse Protocol: Why it is better than your favorite OHM Fork.

The Reverse Protocol is a one-of-a-kind DeFi 2.0 yield generation and treasury strategy protocol built on the HarmonyONE Blockchain.

The Reverse Protocol is a one-of-a-kind DeFi 2.0 yield generation and treasury strategy protocol built on the HarmonyONE Blockchain. The protocol is designed to take advantage of all of DeFi's current strengths while also addressing some of its flaws and vulnerabilities. Because many users mistake it for a direct OHM, this article should hopefully help you better understand the protocol and its various aspects.

Before we get into the details, here's a quick rundown of the protocol's various components and how they interact when you bond and stake. This should help you understand the system's end goals for each component.

Reverseum Treasury:

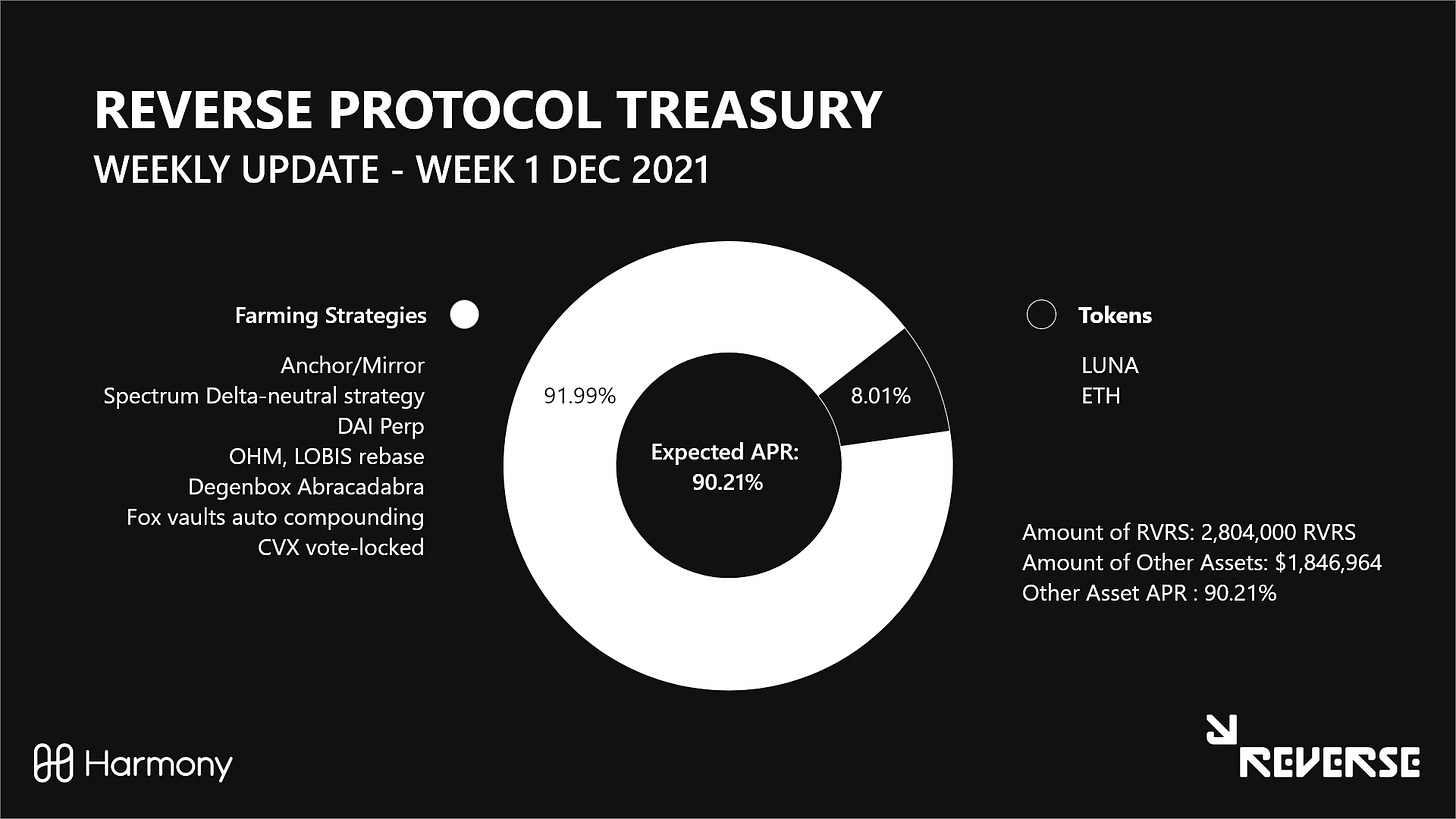

The protocol's treasury accumulates LP tokens and single assets for the protocol's benefit through bonding and community pooling and is governed by RVRS holders. The treasury will never sell any of its RVRS. The Treasury's non RVRS assets are actively managed to maximize its efficiency and benefit the protocol's users.

Once this treasury has value, which it does now, it invests in high-yield investments and yield farms across many chains with optimum capital efficiency in order to maximize yield.

Bonding/Forfeit Pools:

So how does this treasury grow? To begin with, bonding is essentially a way for this treasury to grow.

You as a user can take advantage of Bonding/Forfeit Pools' power by giving the protocol's Treasury either their liquidity pool assets (e.g., RVRS - ONE) or single assets (e.g., UST). In exchange, you will receive a larger part of the RVRS distribution as a booonder/forfeitooor.

When you bond/forfeit, one of the following cases happens:

In the case of liquidity provider tokens, 50% of the bonded assets will be burned, assuring permanent liquidity for the pair, and 50% will be transferred to the Reverseum Treasury.

Single assets, such as UST or DAI, will flow entirely into the Reverseum Treasury, where they will be used to benefit RVRS holders, stakers, and liquidity providers.

How Reverse Protocol mechanisms differ from OHM:

1. RVRS Token:

The RVRS token does not rebase; unlike a rebasing token, it does not have an elastic maximum supply; instead, RVSR has a fixed maximum supply. To further regulate token distribution, there are increased bonding incentives so that the protocol can perpetually replenish the Reverseum pool or burn tokens as needed for the protocol's health.

This is an essential part of the protocol that distinguishes RVRS from an OHM Fork. The treasury is not a risk-free value, and the Reverse tokens do not rebase.

2. Yield Distributions:

The Treasury is our war chest, which we can use to generate yield across multiple chains employing different strategies. One thing RVRS token holders understand is that Treasury is not their value. This does not serve as a receipt for treasury ownership if you hold Reverse tokens.

The Treasury plays a role in Olympus DAO and its forks for its value. The tokens serve as a receipt for the treasury's ownership. In RVRS, the protocol owns the Treasury.

So, what exactly do RVRS holders own and control?

The yield distributions that are determined via governance are what you own. So, if you own and hold Reverse tokens, you have control over the yield distributions governance, and that is one of the values of owning and holding reverse tokens.

You can have a say in how the yield is allocated through governance. There is no value in staking without these yield distributions (which currently has not yet happened on the protocol) making governance meaningless because we are not distributing any revenue from the treasury. This signifies that the token's only value comes from outside sources currently until it soon changes. The declining price chart demonstrates this as one of the factors along with the farmers in the beginning.

How will it get fixed?

The problem would be resolved once yield distributions are initialized, which would correctly incentivize staking because yield distributions provide that incentive. As we promote staking, users will be less likely to sell and new capital will be attracted.

The fresh capital that will bond will result in a growing Treasury, which will raise the yield distribution, and the cycle will continue.

3. Bonding Component Differences:

You can't make a ton of extra yield bonding with OHM or any of its forks because they're pretty good at regulating their dilution rate by keeping bonding rates as low as feasible while still being encouraged.

Some of the other OHM forks have much higher bonding rates, but they don't mention how this is diluting the stakers at a faster pace, because if you're staking but not bonding, the bonding yield is diluting your stake.

How is that not the case with Reverse Protocol? It is, in fact, to some extent. The fact that yield distributions are dependent on treasury size, however, greatly mitigates this risk. Your risk-free value with OHM is considerably below the market price; it's trading at such a premium that Treasury growth doesn't actually boost your value; rather, it helps you catch up to the market value.

As a result, when users bond, they aren't truly raising the worth of their present value of their OHM. So that's why your OHM gets diluted by the higher bonding yield than the staking rewards.

If you want to understand the hidden tax in OlympusDAO forks, here's a video that I recommend:

But with Reverse, Bonding grows the treasury, for which you

actually, get a distribution. When people bond the value of your token actually increases from that Bonding even though you didn't participate in the Bonding and that mitigates the dilution that the Bonding yield produces. However not 100%. Bonders must be incentivized because they are taking on more risk. If you bond and the price of RVRS drops, you will lose potential income compared to buying staking and buying directly off the market.

Because if you buy off the market and stake directly, you can get those treasury distributions without ever putting your capital at risk. This is why bondholders are entitled to a higher yield. Because they are taking risks, sacrificing funds in the expectation of getting future distributions.

People who buy off the market and simply stake are taking no risks because they receive yield distributions and can then walk away.

How to Reversooor:

With the basic outline of the protocol covered, here's what you can do and what you should not do as a Reversoor (3,3).

Unstaking and Bonding: How it affects this system

If a user unstakes, sells half and then reinvests the rest in a bond, all that is accomplished is to recycle the funds back into the system. It divides it in half, putting half in the treasury and the other half in the Reverseum pool. That doesn't harm the protocol, but it doesn't help it because you aren't actually growing anything. It simply aids in rebalancing.

This merely aids in the redistribution of tokens and treasury value within the system. It gives you the possibility of a higher bond yield than simply staking, depending on how the price action plays out during this process.

The disadvantage is that unstaking and selling create selling pressure, which increases the likelihood of the price falling, negating all of the bonding benefits. We've seen this effect on the token price, and it's true that farms had a hand in it.

If yield distributions had been available, you would have noticed that some farmers were staking rather than selling. It wasn't a problem with the farm; rather, it was a problem with staking incentives, which has been the central issue since the beginning. RVRS is not a protocol that rebases. Yield distributions provide the protocol users with their value. RVRS is not a risk-free value system, we're simply a yield distribution system.

So unstaking selling half and reinvesting isn't great for price action, but it doesn't hurt the protocol too much. It's a little boring and doesn't really go anywhere.

So, what's the best strategy?

Now, when you bring in new capital, pair it with your Reverse rewards, bond it, and put it back into the system, you're actually growing the system.

It encourages you to know that it does not create sell pressure; instead, it creates buy pressure, which drives the price up, making your bonding yield actually worthwhile, and it brings more funds into the Treasury, increasing yield distribution and motivating people to stake and hold.

So, if a yield distribution is in place, bondholders are encouraged to sell half and pair the other half with new capital, leaving half of it staked so they can still benefit from yield distributions.

Rebond and bring in new funds, so they start getting their auto stake bonding yields; yield distribution starts coming into their increased amount of stake that they have because they re-bonded and brought in new funds, and there you have it, reversoooooor.

But Ser, I'm a Hyper Degen, I want to be incentivized to max yield potential!

Sure, Anon, For this scenario to factor in, it is really important staking is properly incentivized, which are the incoming stages. With the price decline, this would be a degen accumulation zone, and here's how it can play out.

For this to work, the numbers will have to get to a certain point, but if the Treasury is profitable enough, if our yield farming is profitable enough, the distribution will eventually make it so that you can take your yield distribution, unstake it, pair it with some reverse that you've unstaked, and then reinvest it.

That's right, Anon, you've entered the Degen Reversoor Loop.

You are not required to bring in new capital, but you can still help the Treasury grow.

If you don't want to do that, you can take your yield distribution as profit instead of selling or unstaking your original RVRS staked tokens. If you simply want to start taking profits, you simply take your yield distribution and walk away, leaving nothing behind in this cycle. Since there is no sell pressure on the Reverse token, the price can tend to climb, which is important because we have a finite circulating supply and must maintain price growth. It doesn't have to be aggressive price growth, but the price should always be rising slightly to represent the reverse's slowly diminishing maximum supply.

Yield distribution is a huge factor, and it's one of the main reasons why you should keep the original stake remain staked and auto compounding. First and foremost, it allows you to profit without putting the protocol under pressure to sell; second, it allows you to engage in a high-risk degen loop that can maximize your potential long-term rewards without causing the protocol to suffer significantly.

If you jumped into Reverse Protocol thinking it was an OHM fork, this post will help you understand the protocol. You are being blinded by the macrocycle that is supposed to get the protocol started, in addition to the confusion and drama with the selling pressure. Hopefully, this post helps to solve the problem, and we can get back to work as soon as possible.

Trigs on Discord deserves a shoutout for his video that led to this post. Please feel free to contact him with any questions, and be sure to subscribe to his YouTube channel:

Resources:

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or crypto picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.